The bank of Missouri and Continental finance is offering Cerulean MasterCard for those who don’t have a perfect credit score and want to build credit. Continental finance company is a credit card service provider, specialized in providing credit-related products to the consumer who is overlooked by traditional credit card service providers and banks. On the other hand, Bank of Missouri is a community bank, serving customers since 1891. Cerulean MasterCard allows you to rebuild or improve your credit score while making payment on time and keep your balance under the limit. Cerulean Credit Card is accepted everywhere MasterCard is accepted.

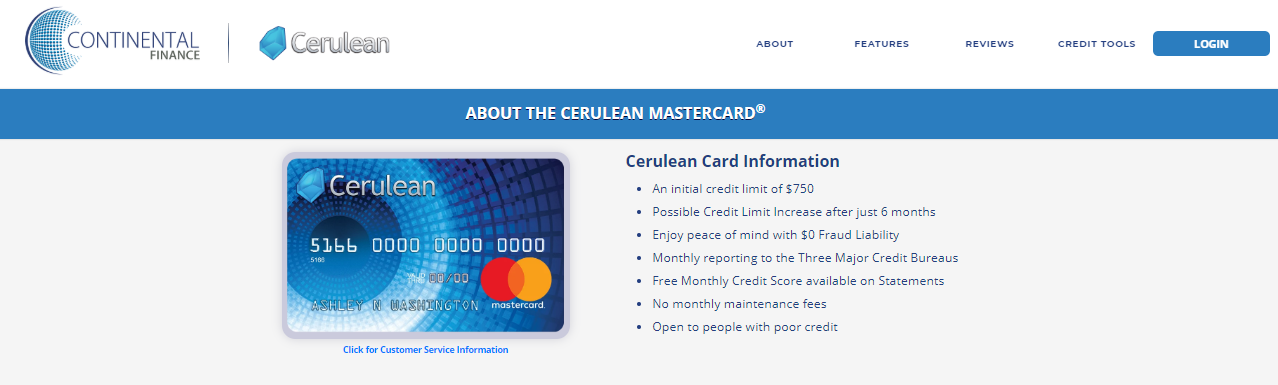

Why Would You Like to Enroll Yourself for the Cerulean MasterCard:

- With Cerulean MasterCard you will get an initial credit limit of $750.

- You would be able to increase your credit score within 6 months.

- You will be covered under zero fraud liability, in case of any unauthorized transaction take place without your consent.

- You will get the free monthly credit reporting from the three major credit bureau.

- You will get your free monthly credit score.

- You can manage your online account from anywhere anytime.

- With the Continental finance mobile app, you can access your account from any device.

How to Apply for the Cerulean Credit Card:

- To, apply for the Cerulean MasterCard credit card through a mail offer, you could visit the following page www.ceruleancardinfo.com

- Now, click on “Accept mail offer”

- Thereafter, you will be required to enter > Reservation code > Social security number

- And, click on “Confirm reservation”

- Thereafter, you will be required to enter your following details

- Full name > Email address > Social security number > Email address > Date of birth > Full address >Employer info > Total gross annual income > Mortgage / rent, etc.

- After finally submitting your application, you will be acknowledged about your credit card approval, which requires a few minutes.

What are the Charges for the Cerulean Credit Card:

- You will be charged 25.90%APR for purchases, based on the market rate.

- You could be charged 25.90% APR for cash advances, based on the market rate.

- To, avoid paying interest on your credit card dues, you could pay your entire dues within 25 days after the close of each billing cycle.

- There will be no minimum interest charge

- You will be charged $99 for your MasterCard annual fees. if you would have any additional credit card, it will be charged $30 for one time only.

- You could be charged either $5 or 5% of each cash advances, whichever will be the higher.

- You could be charged 3% of each foreign transaction for your international purchases.

- And, you could be charged up to $40 for late and returned payment.

Continental Finance Cerulean MasterCard Login :

- To, log in to your Continental Finance Cerulean MasterCard credit account, you could visit the following page www.ceruleancardinfo.com

- Now, click on the “Login” button

- Thereafter, you will be asked to enter your “username” and “Password”

- And, click “Login“

- After verifying your login credentials, who will be able to access your Cerulean MasterCard credit card account

Cerulean MasterCard Login Trouble Shoot:

- To, reset your Continental Finance Cerulean MasterCard credit card account Username or Password, you could visit the following page www.ceruleancardinfo.com

- Now, click on the “Login” button

- After that, you need to click on the alternative link “Forgot username or password” which is provided immediately below the login button.

- Thereafter, you can choose whether you want to reset your username or password

- If you want to reset your Username, you need to click on ” I forgot my username” or else click on ” I forgot my password”

- If you choose to reset your username, you will be asked to enter your credit card following information

- Last 4 digits of your credit card

- Last 4 digits of your Social security number

- Birth date (MMDDYYYY) / 5 digit zip code

- And, click on “Lookup account”

- Or, if you choose to reset your password, you will be asked to enter your account “Username”

- And, click “Submit“

- After authenticating your account details, you will be able to reset your Continental Finance Account username or password.

If you need any assistance or have any queries, regarding the Cerulean MasterCard Credit card, you could contact Continental Finance through the following

Read More: Access To Merrick Bank Credit Card account

How to contact Cerulean MasterCard Customer Support:

To get a quick response, you can contact their customer support executives, through the following number

1-866-449-4514

To, report of lost and stolen card –

1-800-556-5678

To, apply for a cerulean credit card through the phone –

1-866-513-4598

Reference – www.ceruleancardinfo.com