Guide to Activate of Wisely Pay Card:

There are many households in the US that are underbanked or they do not have any banking account. For them, a very important aspect is a payment card, so that they can pay their deeds through the electronic service. Wisely pay card is a huge opportunity for the ones who do not want to have a bank account.

It is a worker-focused payment solution that is paperless and is designed to offer ease to employers and offers financial wellness to the workers. The pay is directly given into the Pay Card account, and there is no such hassle for the payment to be deposited in the bank account.

The Wisely Pay Prepaid Card and Debit Visa or MasterCard are issued by the Fifth Third Bank. This card can be used everywhere and is accepted everywhere.

This card comes in two forms:

- Wisely Pay Card – this is the debit visa that allows the employees to choose a Pay Card provided by their employer.

- Wisely Direct – this is a debit MasterCard and the workers can opt to have a reloadable card program that is provided directly to the customers by ADP.

With the My Wisely app, employers can manage their money o how to spend, where to spend, and save. This app gives them bank-like features and also comes with financial wellness tools.

Benefits of the Wisely Pay Card:

- The direct deposit of your pay and other sources of income can be paid up to 2 days early without any cost.

- When you do any purchases, you can get 10% cash back rewards, and this card is compatible with Apple Pay, Google Pay, and Samsung Pay.

- You can save your money as you don’t have to pay any overdraft fee or direct deposit. Visa is accepted everywhere, so you can make all your payments with ease at the store or online.

- There are over 80,000 ATMs, 12000 over-the-counter bank locations from where you can get free cash without any extra charge. You can also gain the same from the register of major retail locations nationwide.

- As mentioned above, the app can help employees track their spending and savings.

- It has an EMV chip that provides security to your card and also comes with $0 fraud liability and the card is also insured by FDIC.

- As this is a companion card, you can order up to three extra cards for your family and trusted individuals.

Also Read: Activation guide for Mercury MasterCard Online Account

The other factors to be kept in mind:

- When you take out money from the out-of-network domestic ATM, you will be charged $2.50.

- You will be charged around $3 for the international purchase and international ATM currency transaction ATM fee.

- If your card gets stolen or lost, you will be charged $6 if your card is replaced with standard mailing per card, and the fee would increase to $30 if it is mailed with expedited mailing per card.

- If to opt to have a secondary card, you will be charged $24 for expedited mailing per card, and for the same, you will be charged $0 with standard mailing.

Activation Procedure of the Wisely Pay Card:

- The first thing to keep in mind is that you have an internet connection.

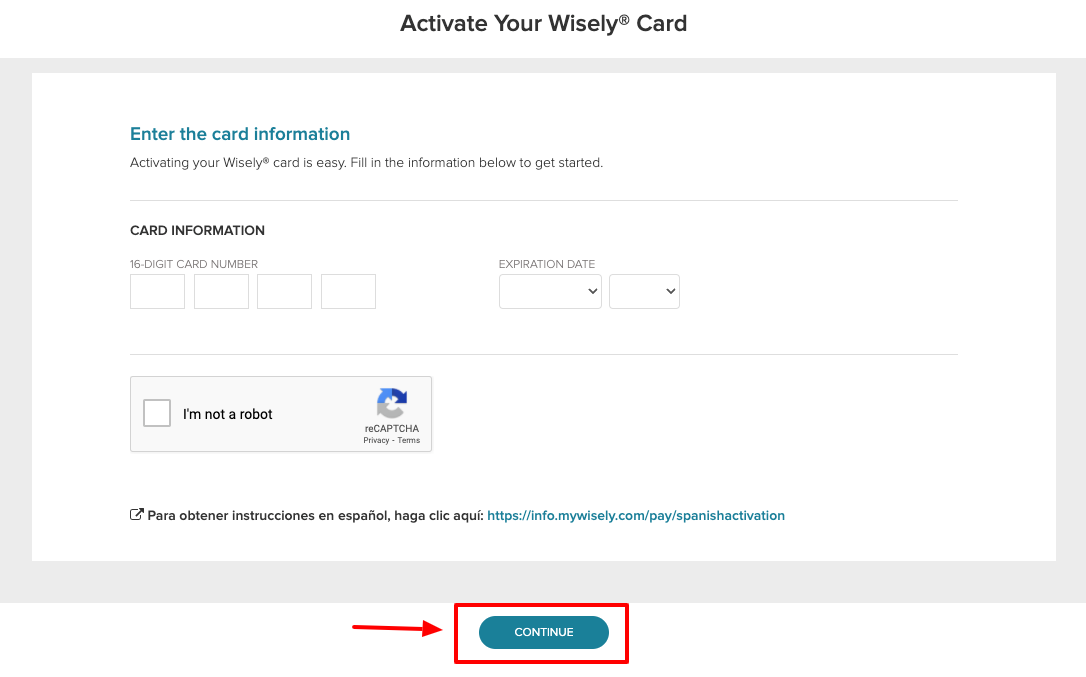

- Then go to the activation website of the wisely pay card, or you may follow the link activatewisely.com.

- On the page, you need to enter your 16 digit card number and the expiration date.

- Then you need to click on the box I’m not a robot.

- Now, the credentials given by you need to be checked for surety and after you are done, you can click on the Continue button.

- Follow the prompts, and your card is activated.

Activating the Wisely Pay Card via phone:

If you want to activate your card via phone, then you need to call on the number 1-866-313-9029.

Some Frequently Asked Questions (FAQs):

- How can I add cash to my card?

Ans. You can actually do this with a number of options –

- Reload the register – with a fee of $4.95, your cash can be added to the card at every major retailer.

- You can visit the western union for the same.

- There are retail locations where your cash can be added at a fee of $5.95.

Will I be able to transfer funds to my bank account or another card?

Ans. For transferring the funds, you need to upgrade your card first.

- Register and log in to the My Wisely Mobile App or you may go to mywisely.com.

- Then you need to click on the transfer arrows present in the upper right corner.

- Now, you have to enter the routing number and the account number of the bank to which you want to send the money or card and complete the transfer.

You have to keep in mind that the procedure of transfer may take 3 business days for the enrolling and transferring.

- What shall I do if my card is stolen and is used without my permission?

And. Since your card is insured by FDIC, there is nothing to worry about as you won’t be held for any unauthorized purchase. You need to lock your card using the My Wisely app so it cannot be used for any purchase. But you need to report it to customer care by calling at 1-866-313-6901.

- What if I want to change my PIN?

Ans. You need to go to the My Wisely App, tap on the card settings, and change the PIN.

Conclusions:

This article deals with the benefits and the activation procedure of the wisely pay card. While going through the article if you face any problem, you can always contact them on the number 1-866-313-6901. You can go to their help page on www.info.mywisely.com, and there you can find many FAQs that can help you with your dilemma if any, and you can also go to the bottom of the page if you are willing to find any ATM by clicking on the ATM locator.

Reference: