How to Get Flexible Payment Options of One Main

OneMain Holdings is a budgetary administration holding organization. The Company is a customer account organization, which is occupied with giving individual advance items; credit and non-credit protection, and administration advances possessed by it and administration or subsurface advances claimed by outsiders. The Company’s sections incorporate Consumer and Insurance; Acquisitions and Servicing; Real Estate, and Other. It is occupied with seeking after key acquisitions and miens of benefits and organizations, including credit portfolios or other money-related resources.

The Company begins and administrations individual advances through two business divisions: branch activities and concentrated tasks. As of December 31, 2016, its joined branch activities included more than 1,800 branch workplaces in 44 states. It offers discretionary credit protection items to its clients, including credit incapacity protection, credit extra security, credit automatic joblessness protection and guarantee assurance protection.

The United States Department of Justice required Springleaf to offer 127 branches and certain related advantages for Lendmark Financial Services, LLC. prior to the merger. The deal was finished in May 2016. The brand relocation from Springleaf Financial to OneMain Financial was finished in October 2016.

A bill presented in California enactment that would restrain financing costs outstandingly rejects three loan specialists, OneMain being one of the three banks. The explanation these loan specialists are absolved from the bill is on the grounds that their advantage is topped at 36 percent, anyway as indicated by a Pew study the APR is downplayed because of the forceful selling of extra items.

How One principle financial functions

An individual credit is one approach to deal with the scope of costs life can bring your direction – from obligation union to get-aways to clinical expenses. An individual advance from OneMain offers fixed rates and fixed installments. The rate and item you fit the bill for relies upon different elements including term length, advance size, record as a consumer, salary, costs, other monetary commitments, and the accessibility of security

Complete their online application

Reveal to them a portion of your own, business and budgetary data and get a snappy choice on your credit demand.

Meet with your advance master

Whenever affirmed, they’ll have you visit a branch to check your work, character, pay, costs, and insurance and talk about your alternatives.

Sign and get your assets

After you survey and acknowledge your advance terms, you’ll sign your credit records and get your cash.

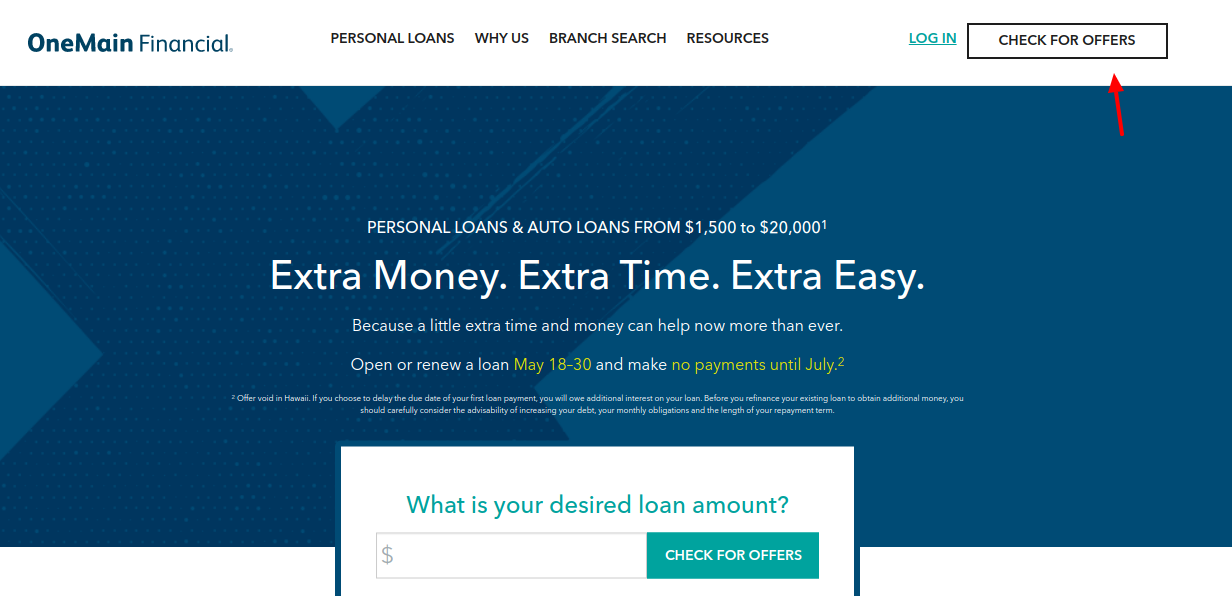

How to check the offer of One main financial

To check the offers go to, www.onemainfinancial.com

Here, at the top right corner tap on, ‘Check for offers’. You need to input,

Desired Loan Amount:

First Name:

Middle Initial:

Last Name:

Email

Home Address

Apt. Number (optional)

Zip

City

State

Phone Number:

Date of Birth:

The last 4 digits of Social Security Number that you have with you

Monthly Net Income:

Source of Income

Agree to the terms and rules

Then, tap on the bottom left part, ‘Check for prequalified offer’.

Look up mail received offer of One main financial

If you have received a mail then, go to, www.onemainfinancial.com

Here, at the top right corner tap on, ‘Check for offers’. Here at the middle right section ‘Received a mail’, under that tap on, ‘Look up my offer’. Here input,

Offer Number

The last 4 digits of Social Security Number that you have with you

Then, tap on the button, ‘Look up my offer’.

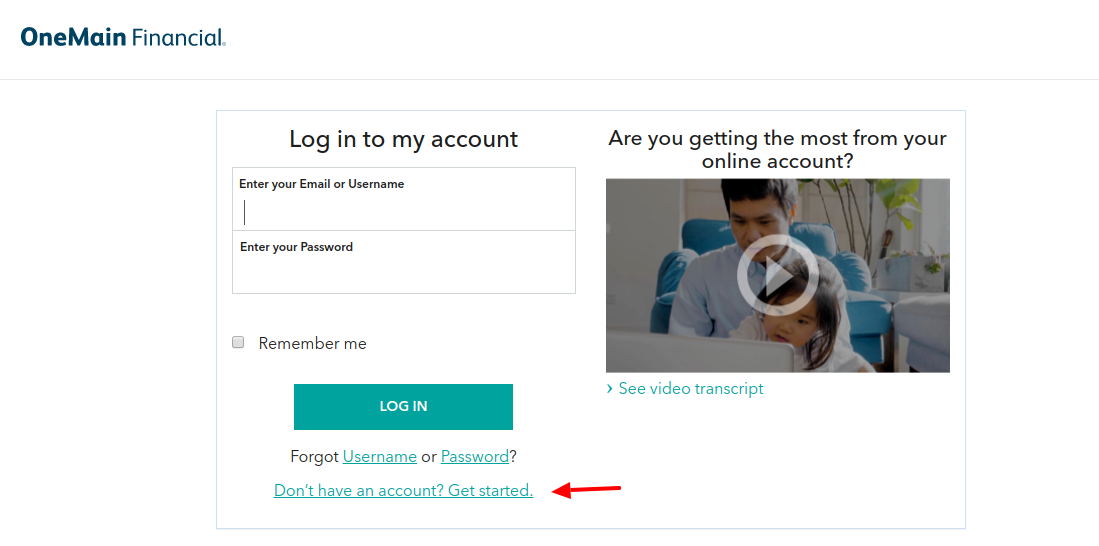

How to sign up for One Main financial

To sign up visit, www.onemainfinancial.com

Here, at the upper right part tap on, ‘Login’. Here, at the middle you will get the login initials, under that tap on, ‘Don’t have an account? Get started’. Here provide,

First Name

Last Name

Account Number:

The last 4 digits of SSN that you possess:

Zip

Then, tap on, ‘Create online account’.

How to sign in with One main financial

To sign in the visit, www.onemainfinancial.com

Here, at the upper right part tap on, ‘Login’. Here, at the middle part of the prompted page, you will get the login initials, here you need to give info,

Email or username

Password

Then, tap on, ‘Login’.

Login help

Need login assistance? Go to, www.onemainfinancial.com

Here, tap on, ‘Forgot Username or Password?’. For username type,

First Name:

Last Name:

The last 4 digits of SSN that you possess:

Zip Code:

Then, tap on, ‘Show my username’.

For password input,

Email or username

Then, tap on the button, ‘Continue’.

Also Read : Access To Your House Beautiful Magazine Account

How to pay for One main financial loan

Pay without login: For this go to, www.onemainfinancial.com

Here, at the upper right part tap on, ‘Login’. Here, at the middle part of the prompted change, you will get the login blanks. At the bottom, go to, ‘Don’t have an account? Get started’.

Here at the middle tap on, ‘Make a payment without an online account’. For this type,

First Name

Last Name

Account Number:

The last 4 digits of SSN that you possess:

Then, tap on, ‘Make a payment without an online account’.

Online payment: You can pay online by registering and login with this link, www.onemainfinancial.com

Auto payment: You can set an auto payment with the loan company by going to www.onemainfinancial.com, and then, login to the account. You can also set a direct payment and a one-time payment this way.

In a branch: For this, you need to find a branch by going to, www.onemainfinancial.com. Here, from the upper side ‘Branch search’, tap on that.

Here at the middle provide details,

State, city or zip code

Then, tap on ‘Search’.

You can also check the list of cities they offer services.

In the branch, you can pay with these methods,

Traveler’s check

Personal check

Payroll check

Cashier check

Third-party personal check

Money order

ACH

Government check

Debit card

Bank draft

Insurance draft

Pay by phone: To pay this way you need to call on, 1-800-290-7002.

Pay by mail: To make payment with the mail you can send the payment to, 601 N.W. Second Street

Evansville, IN 47708-1013. You can make payment with,

Money order

Personal check

Cashier check

Connected retailers pay: This way you can pay with connected retailers like, PayNearMe, Family Dollar stores, Casey’s General Store, 7-Eleven and so on.

With the One main app: This is available for both Android and iOS, and you have to tap on, ‘Make a payment’, then, follow the later instructions to pay the bill.

Contact help

If you are looking for further support call on, (800) 742-5465. Or write to, 601 N.W. Second Street. Evansville, IN 47708-1013. You can also check these media pages,

Reference :