Guide to Spotloan Review and Sign In

Loan needs can come at any point in life, so when you need that you must look for a reliable company that gives you better benefits and facilities that one looks in the loan payment. Such company is Spotloan which is acquired by BlueChip Financial, an innately claimed substance composed under and administered by the laws of one of the nation’s biggest governmentally perceived Indian Tribes, the Turtle Mountain Band of Chippewa Indians of North Dakota.

Since its foundation in 2012, Spotloan has given practically a large portion of a million credits to a huge number of Americans out of luck. Spotloan highly esteems magnificent client support all done from the call place procedure on the booking in Belcourt, North Dakota.

As an immediate bank of online advances, Spotloan is altering the crisis advance market by using the world’s most refined FinTech innovation. Spotloan utilizes AI through computerized reasoning and large information to recognize extortion and foresee recompense. They give online credits straightforwardly to borrowers through the work area or cell phones, guaranteeing those advances surprisingly fast without making the candidate round out an extensive application.

Spotloan is a significant piece of monetary advancement for Turtle Mountain. We give truly necessary chances to a network confronting significant occupation misfortunes and joblessness paces of over 65%. Spotloan likewise gives basic income to the innate government for its numerous network projects.

Why choose spot loan

Payday advances don’t give you the time you have to take care of your credit. All things considered, on the off chance that you had $500 to save in about fourteen days, okay truly need to obtain it today? Likely not. Advance expenses don’t lessen your parity.

At the point when you make an installment to rollover your credit, it doesn’t really represent a mark against the parity you owe which takes you further in debt. The opportunity to take care of your Spotloan whenever with definitely no prepayment punishment

Spotloans are customized to meet your requirements. You pick your credit sum and the size of the payment. Also, you get to choose to make customary planned installments or pay the credit off right on time. Whatever you pick, they’ll work with you to keep you and your advance on target. A superior rate on your next advance with us in the wake of finishing your first advance with Spotloan. Exceptionally prepared Relationship Managers to help you at all times.

How Spotloan works

You need to pick your terms

Then fill out an online application

Upon approval, you will get cash in your bank account

Sign up with Spotloan

To sign up go to, www.spotloan.com

Here, at the top right side click on, ‘Login’.

At the next directed page, you will get the login blanks. Here click on, ‘Set up online access’. Here, enter,

Email Address

Date of Birth

Last four of your SSN

Then, click on, ‘Submit’.

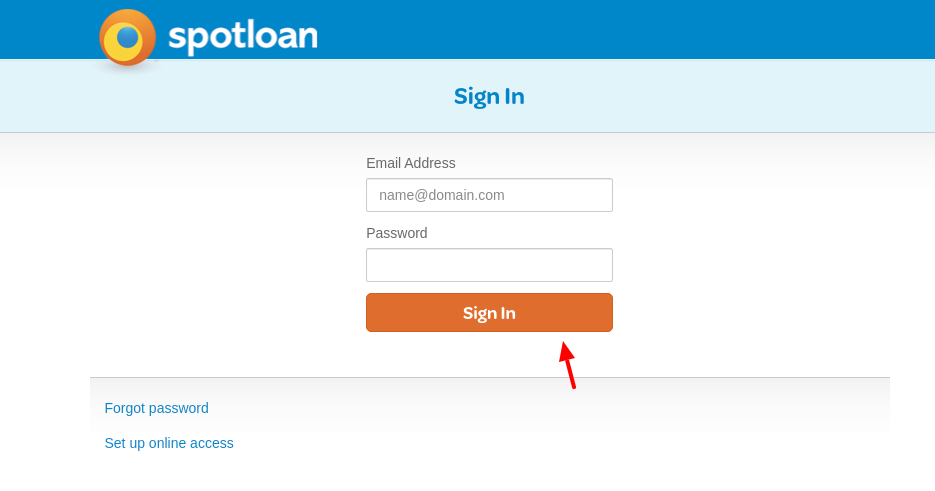

Sign in with Spotloan

To sign in go to, www.spotloan.com

Here, at the top right side click on, ‘Login’.

At the next directed page, you will get the login blanks. Here enter,

The registered email

The password

Then, click on, ‘Sign in’.

Forgot password

If this is the case go to, www.spotloan.com. Here, click on, ‘Forgot password’, then type,

Email Address

Date of Birth

Last four of your SSN

Then, click on, ‘Submit’.

Apply for Spotloan loan

To apply to go to, www.spotloan.com

Here, at the middle right side type,

Your borrow amount

How much you want to pay

Then, click on, ‘Apply now’.

In the next directed change at the middle enter,

First Name

Last Name

Social Security Number

Date of Birth

Email Address

Phone Number

Primary Phone Number

Second Phone Number (Optional)

Address

Suite or Apartment number

Address

City

State

Zip Code

Years in the residence

If you have your own home or rent

Mortgage or the amount of rent

Specify if you have ever been evicted

Then, from the bottom click on, ‘Next step’ in yellow.

Also Read : How to Access Michelin Rewards Account

Spotloan review

Spotloan shares a great deal for all intents and purposes with payday loan specialists. It offers little advances somewhere in the range of $300 and $800, and there’s no base FICO rating to apply. Loan fees are additionally 450 percent APR, which is high by any standard. You can get your cash inside a day of applying, be that as it may, and you can pick your advance term anyplace between three to eight months. In case you’re battling, you may even have the option to incidentally delay your installments. There are no concealed expenses and you won’t be charged for taking care of your advance early either.

The pros of Spotloan

Loan Amounts are $400 to $800

Loan Terms is Three to ten months

Biweekly Payment Schedule

In Business Since the year 2012

No minimum credit score

No prepayment or hidden

Get cash the next day

Get the option to pause payments

The cons of Spotloan

APR is as high as 490%

Not For reasonable interest rates

Contact help

To get further help you will get this info,

Phone: (888) 681-6811

Monday to Friday 7 am to 8 pm CT

Saturday 9 am to 6 pm CT

Mail: P.O. Box 720

Belcourt, ND 58316

Email: help@spotloan.com

Reference :